Key Points: Sale of warehoused goods in FTWZ on 'as is where is' basis to bonded warehouse is exempt from GST. Duties under Customs including IGST are not required when goods are not cleared for home consumption. Amendment to Schedule III of CGST Act (from 01.02.2019) clarifies this exemption. IGST is levied only at the point of clearance for home consumption. Rule 46(13) of SEZ Rules allows duty-free transfer to bonded warehouse Explanation : When...

2024-06-01

Goods or articles specified in Aluminium and Aluminium Alloys (Quality Control) Order, 2023 shall conform to the corresponding Indian Standard and shall bear the standard mark under a license from the BIS. Implementation Date (as per QCO Amendment 2024 03.05.2024): 1 December 2024 Aluminium and Aluminium Alloys(Ingots and Castings) IS 617:1994 Aluminium and Aluminium Alloys (Aluminium ingots billets and wire bars (EC GRADE)) IS 4026: 2023 Aluminium and Aluminium Alloys...

2024-05-27

Goods or articles specified in Copper Products (Quality Control) Order, 2023 shall conform to the corresponding Indian Standard and shall bear the standard mark under a license from the BIS. Implementation Date (as per QCO 2024 25.04.2024): Enterprises (Other than Micro and Small) : 19 October 2024. Medium Enterprises : 19 January 2025 Micro Enterprises : 19 April 2025 Product Name : Copper Products(Copper Wire Rods for Electrical Applications) IS 12444:2020 Copper...

2024-05-24

Attention of Trade and Industry is drawn towards the extension of Interest Equalization Scheme (IES) upto 30.06.2024, as notified by RBI vide its Circular No. DOR.STR.REC.78/04.02.001/2023-24 dated 22.02.2024. In this regard, it may be noted that a cap of Rs. 2.50 Cr per IEC is imposed till 30.06.2024 for the quarter starting from 01.04.2024.

2024-04-02

COO - UK Developing Countries Trading Scheme ( DCTS) It is hereby informed to all concerned that the United Kingdom (UK) has replaced its existing origin declaration process under Generalized Scheme of Preferences (GSP) with the “Developing Countries Trading Scheme (DCTS).” Goods that meet the UK DCTS Rules of Origin (RoO) requirements shall be eligible to claim a concessional rate of import duty for exports to the UK. Indian Exporters accordingly are directed to use...

2024-04-03

BIS- Importability of items under Advance Authorisation without compliance to the mandatory Quality Control Orders (QCOs) Conditions : 1) Pre-Import condition 2) Exemption from mandatory QCOs shall be specifically endorsed in the Advance authorisation. 3) Unutilised imports or the products manufactured shall not be transferred to DTA,even after regularisation. 4) The unutilised material shall be destroyed in the presence of jurisdictional GST/Customs authorities or same may be...

2024-04-02

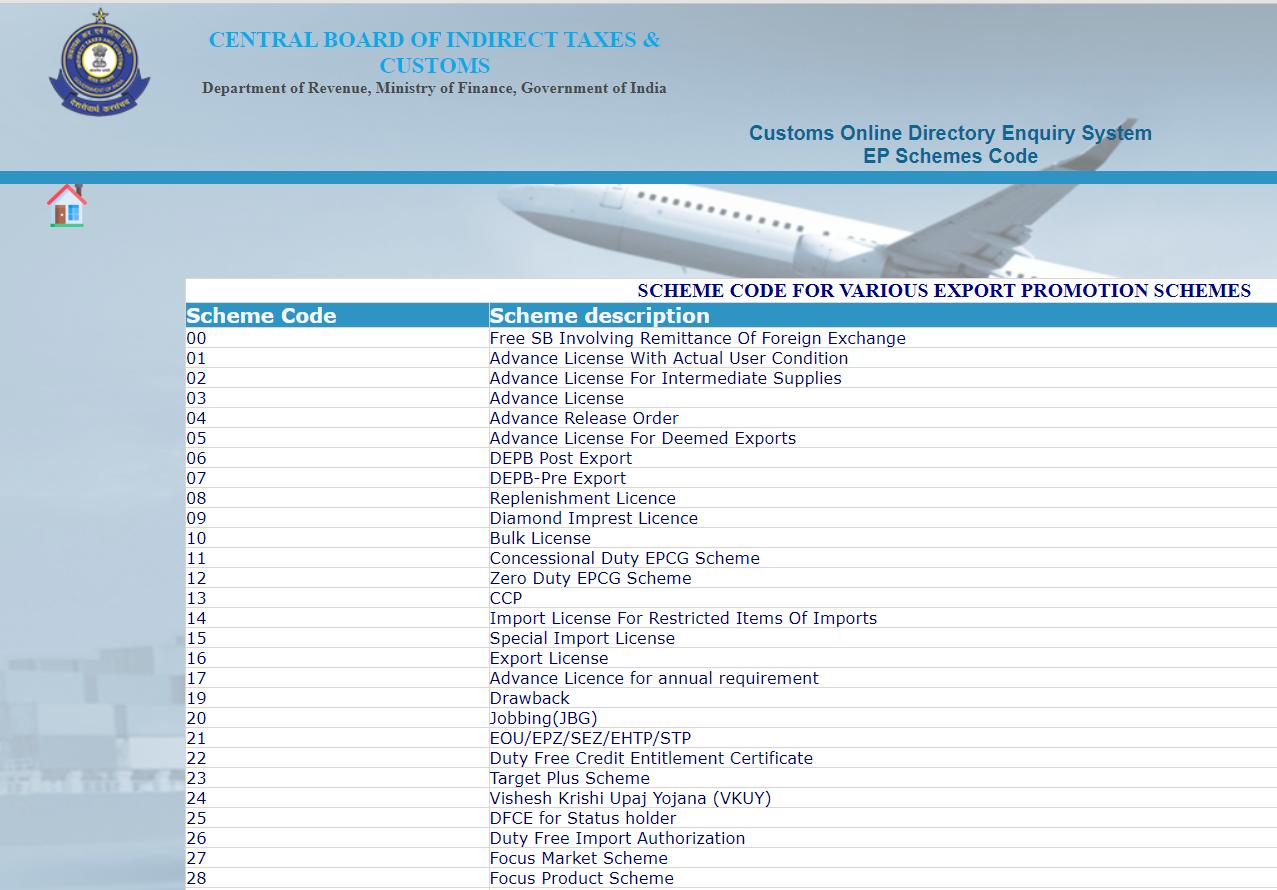

Very Important ! SCHEME CODE FOR VARIOUS EXPORT PROMOTION SCHEMES Scheme Code Scheme description 0 Free SB Involving Remittance Of Foreign Exchange 1 Advance License With Actual User Condition 2 Advance License For Intermediate Supplies 3 Advance License 4 ...

2023-12-01

Import of Goods at Concessional Rate of Duty or for Specified End Use These rules shall apply where - a. notification provides for the observance of these rules; b. an importer intends to avail the benefit of any notification and such benefit is dependent upon the use of the goods imported being covered by that notification for the manufacture of any commodity or provision of output service or being put to a specified end...

2022-09-09

Overview India allows manufacturing and other operations in a bonded manufacturing facility to promote India as the manufacturing hub globally and the commitment towards ease of doing business, Customs (CBIC) has announced a scheme of Customs Bonded manufacturing cum warehousing commonly known as MOOWR i.e. Manufacturing and other operations in a Warehouse. Central Board of Indirect Taxes (CBIC) is allowing import of raw materials and capital goods without payment of duty for...

2020-08-07

Overview ! The RoDTEP Scheme came into existence because USA have challenged export promotional Scheme included in FTP in India at the World Trade Organization (WTO). USA argued that India is not complying with Articles of Subsidies and Countervailing Measures (SCM) Agreement and offering subsidies like the MEIS scheme which is an undue benefit to Indian exporters & it is against the WTO rules. As India lost the case at WTO, and the ruling was in favour of the USA. Also, WTO Instructed India...

2020-07-07

Drawback was established in 1789 in order to promote exports and manufacturing within the U.S. market. Claimants can recover the duties, taxes and fees paid on the imported merchandise. As old as the hills Duty drawbacks, essentially, are post-export replenishment/remission of duty on inputs used in export products. In other words, many governments, particularly those in highly protected economies, refund all taxes paid by an exporter – be it customs duty, service tax or excise duty –...

2020-06-08

The ministry has also launched Common Digital Platform for issuance of electronic Certificates of Origin (CoO). The platform will be a single access point for all exporters, for all Free Trade Agreements (FTAs)/Preferential Trade Agreements (PTAs) and for all agencies concerned. Certificate of Origin will be issued electronically which can be in paperless format if agreed to by the partner countries. Authorities of partner countries will be able to verify the authenticity of certificates...

2019-09-16

Steel Import Monitoring System (SIMS) Advance information about steel import to government and other stakeholders, including producers and consumers, to have effective policy interventions.(launched by The Commerce and Industry Ministry ) In this system, the importers of specified steel products will register in advance on the web portal of SIMS, providing necessary information Starts From SIMS has been notified with effect from 1.11.2019. i.e. Bill of...

2019-09-16

You must be aware that, Since last few months the MEIS scheme was challenged by the United States at the World Trade Organisation and there is huge pressure from various export organisations, councils, trade representatives and consultants on government for continuation of Export Incentives to compete in international trade. Also it has been represented to government with request of reimbursement of various duties and taxes are still manufacturers are not able reimbursed like. VAT &...

2019-08-01

The proposal is part of a 100-day action plan prepared by the ministry for the new government which will take office on May 30. A new export promotion scheme has become necessary as the existing merchandise exports for India (MEIS) scheme is being opposed by the US in the World Trade Organisation (WTO), stating it is not in compliance with global trade norms, the official said. The new scheme could be named as Central and State Taxes and Levies Scheme. According to the proposal, the...

2019-05-27

Circular No. 11/2019-Customs dtd 09.04.2019 In order to enhance the ease of doing business for exporters, DGFT has decided to phase out physical copies of MEIS and SEIS Duty Credit Scrips issued with EDI port as port of registration. DGFT has issued Public Notice No. 84/2015-2020 dated 03.04.2019 and Trade Notice No. 03/2015-2020 dated 03.04.2019 notifying this change. This shall come ...

2019-04-09

Under the old rules which were in operation in February and March, in most of the cases, IGST credit used to get exhausted in IGST and CGST payments in order. CGST credit used to stay in the system un-utilised, and businesses had to make cash payments for SGST. Now, under the modified rules, the taxpayer can choose to pay off SGST using IGST credit, even if the latter is not used to set off CGST liability. This will improve the efficiency of credit utilisation in the GST system, while...

2019-03-31

Chennai Customs has raised an audit query that ‘Social Welfare Surcharge (SWS)’ cannot be debited in the MEIS/SEIS Licence. They have started issuing notices to importers demanding payment of SWS duty. But the Customs EDI System itself does not have the option to debit only the Basic Duty in MEIS/SEIS Licence. This point has been raised with the Chennai Customs & they have put up with ‘Director General Systems’ to make the necessary amends in the Customs EDI System. Other...

2019-03-31

Coverage All eligible Agri. Exporters duly registered with relevant export promotional council are entitled for this scheme. Assistance at notified rates will be available for particulars product exported to particular country Applicability Scheme will be applicable from 01.03.2019 to 31.03.2020 List of Products & country of destination For products covered under Ch. 01 to 24 except of products notified (List as per Table A) For particular country’s (List as per Table...

2019-03-29